Simple accounting software that makes you even smarter.

Simple, beautiful, and powerful, Quick Business Payroll gives you the tools and intelligence to take your business to the next level.

Simple, beautiful, and powerful, Quick Business Payroll gives you the tools and intelligence to take your business to the next level.

It’s simple to create and customize an invoice, add your logo and personalize your “thank you” email. With the best in class accounting suite like FreshBooks, you can easily add tracked time and expenses to your invoices so you’ll never leave money on the table again.

Simply enter your expenses and FreshBooks accounting software will digitally store and automatically organize them for you. You’ll know at a glance what you’re spending and how profitable you are, without the headache of spreadsheets or shoeboxes.

Make it easy for your clients to pay you quickly and easily—straight from your invoice! With FreshBooks accounting software your clients can pay you by credit card in just a couple of clicks. The fee structure is straightforward and transparent, so there’s no guessing involved.

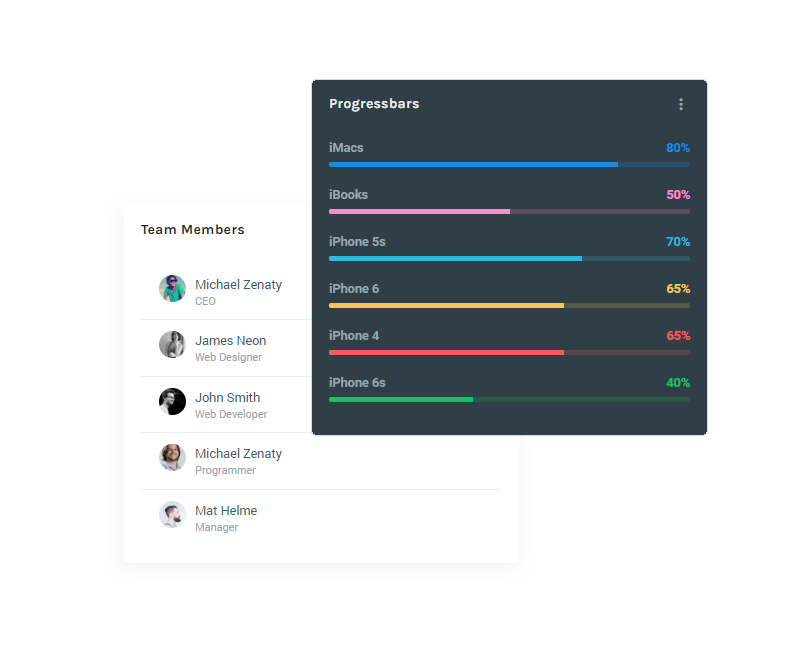

Features

Over a hundred thousand businesses use Host Soft daily to track expenses, send invoices, get paid and balance their books.

Quick Business Payroll puts time back in your day. With the ability to automate tasks like organizing expenses, tracking time and following up with clients, Quick Business Payroll accounting software works hard, so you can rest easy.

Wow your clients with sleek looking estimates and invoices that show off your brand. Whether you’re on your own, or running a team, it’s easy to look like the professional you are with Quick Business Payroll accounting software.

Never chase down another check. Quick Business Payroll accounting software offers online payment Quick Business Payrolls that will make your client happy, and get you paid 11 days faster. Now that’s a win-win.

FreshBooks empowers you to work smarter, not harder. It puts precious moments back in your day and helps you identify opportunities to be more productive and efficient.Getting started with FreshBooks is simple. No experience with accounting software is necessary and in just seconds you can create professional looking invoices. Plus you’ll be able to manage your expenses with ease, track your time and collaborate with team members and clients. You’ll gain insights that’ll take your business to the next level, and get paid fast – while never having to leave FreshBooks.It’s all here for you in one smart accounting suite.

Log in online anytime, anywhere on your Mac, PC, tablet or phone to get a real-time view of your cash flow. It’s small business accounting software that’s simple, smart and occasionally magical.

Testimonial

Manager

My accountant was able to log in and file my tax returns last tax season and that is a big one for me. He did agree with me that Quick Business Payroll works.

CEO

Quick Business Payroll helped to streamline and simplify the invoicing process. Also, Quick Business Payroll offers unique invoice templates that are easily customizable.

Accountant

Quick Business Payroll has helped our team to improve productivity, save time and manage more clients in less time. It is really a ‘WOW’ platform to work on.

Manager

I manage 100% of my business with Quick Business Payroll. It’s easy to use and affordable and my customer relationship has never been smoother.

Manager

I save a lot of time with having a single place to create estimates, invoices,

record payments, and all integrated with my CRM.

Frequently Asked Questions

Find answers to all the common questions you might have.

Many small and mid-sized businesses fail to adequately measure and manage their finances, even though poor financial management is a major cause of business failure. If you don’t have good financial practices in place, your business could suffer in a number of ways:

Our monthly accounting process starts with receiving your source documents. Our staff compiles the information and reports back to you with the following to help you take back control of your finances:

We also include the following services:

Our customer service sets our firm apart. We make it our priority to reach out to clients on a consistent basis because we care about the success of your business. Our experienced team of accountants also provide proactive business advice and tax planning, allowing you to maximize your profits.

Need to reach out? No problem! Other accountants will bill you by the minute, but a unique benefit that we offer is allowing our clients to contact us as much as they’d like – at no additional cost.

If you are looking for an outsourced accounting solution based on price alone, annual accounting may be enough for you. However, if your business is the right fit for monthly accounting services, they provide substantially more value than an annual service.

If an accountant only sees your numbers once a year, it’s too late to offer advice that would have helped to make that year more profitable - and definitely too late to lower your tax liability for a year that is already over with. Read about the benefits of tax planning and tax projections, two things that an annual accountant can’t provide you.

You can also read about why you don’t need to work with an annual accountant if you have a monthly accountant.

Please note that while we can handle your personal taxes as well if you are a business client of ours, many of our clients still choose to have an annual accountant do their personal taxes. Read more about having Enterprise Sage Books do your personal taxes (as a sole proprietorship and separate business/personal entities) here.

There are a variety of pros and cons for every accounting service, and we know that we aren’t the best solution for everybody. When you don't know the differences between outsourced accounting options, it's difficult to make the best decision for your business.

If you trust other local vendors to help with your operations, why not trust a local accounting firm? Don’t automatically go for a name you recognize or the lowest price without doing your research first.

Trust your gut. If you’re already thinking about leaving your current accounting firm, then you’re ready to move on. Read more about these fears that disrupt business growth:

Don’t forget the necessary steps to move forward once you make your decision. If you’d like, we can help you with the process. Read more about these steps to change accounting firms:

Enterprise Sage Books will file multiple years of back taxes for you at once when you come on board. In fact, if you haven’t been filing your taxes, we require this.

If your taxes are not up-to-date, then your accounting won’t be accurate. We want to provide a quality accounting service for you, so we will need to start with a clean slate. After your accountant has the information that they requested from you in your initial strategy sessions, they are dedicated to getting your records caught up and accurate, as well as getting your financial statements and tax returns done.

We do back taxes for payroll too! You or your payroll specialist need to be paying taxes and filing payroll returns. If this hasn’t been done, you’ll need to get your payroll back taxes done. Our software helps us file your old payroll returns. Plus, when we make amendments to your W2s, we can print them and have the final product in your hands as soon as they’re done.

Pricing for our monthly accounting services varies by your company’s needs. It is not based on the size of your company, rather your company’s accounting activity and the complexity of your financial statements.

Our average accounting fee comes out to about $675 per month. Depending on these factors, your fee can range between $500 to $1,000+ per month. We will work with you to arrive at an affordable, fixed monthly fee.

To efficiently help you with your business goals, we require access to your online accounts and source documents, either in electronic or hard copy form. Common documents include, but are not limited to:

We recommend having you handle the day-to-day aspects of your business that need immediate attention, such as paying your bills, and we'll handle the monthly accounting and bookkeeping.

Some owners want to continue to handle the bookkeeping portion internally. Enterprise Sage Books allows this, although we don’t necessarily encourage it. Before we even consider this option, we would like you to have a professional bookkeeper on staff. Doing your own bookkeeping may hinder you more than it helps you if mistakes occur.

Yes. Audit representation is included in your monthly accounting fee. The only time that we would charge for audit representation is if the audit is for a time period during which you were not our client.

Enterprise Sage Books offers agent-level support, meaning that we deal with the IRS agent directly in the case of income tax audits. Almost all of these issues are resolved at the agent level and never need to go to tax court. If we’re preparing your monthly sales tax returns, we will also represent you in a sales tax audit.

Pricing

We are providing be services at cheap price. Select plan which shoot your requirment.

Reporting

Cash Flow, Budgeting and Forecasting

Payroll

Sales Tax

Accounts Receivable Management

Accounts Payable Management

Basic +

Annual 1099 and W-2 Processing

Controller Services

Factoring Accounting

Individual tax return preparation

Corporate tax preparation

Premier +

Strategic tax planning

Electronic filing (E-File)

Business Plan Development

State Tax ID Applications

24/7 Account Manager